Let’s be honest: when you’re in your twenties, retirement feels like a concept from another universe. You’re thinking about weekend plans, career moves, maybe buying your first car or apartment—not what you’ll be doing in 40 years. But here’s the plot twist that could change your financial future forever: the decisions you make today about retirement savings could literally be worth hundreds of thousands of dollars later.

This isn’t about being boring or giving up your youth to save every penny. It’s about understanding one of the most powerful forces in finance—compound interest—and using it to your advantage while you still have time on your side. Think of it as planting a money tree: the earlier you plant it, the bigger it grows.

The Magic of Starting Early: Why Time Is Your Secret Weapon

Imagine two friends: Sarah and Mike. Sarah starts saving $300 a month for retirement at age 25. Mike waits until he’s 35 to start, but he saves $500 a month—nearly double what Sarah saves. Who do you think ends up with more money at retirement?

Surprisingly, Sarah does—even though she contributes less each month. Why? Because she had an extra 10 years for her money to compound and grow. Those extra years mean her investments have more time to earn returns, and then those returns earn returns, creating a snowball effect that’s hard to beat.

This is why financial experts get so excited about young people saving for retirement. It’s not just about discipline—it’s about mathematics working in your favor. The longer your money has to grow, the less you actually have to save from your own pocket to reach the same goal.

Understanding Compound Interest: Your Money Working While You Sleep

Compound interest is often called the “eighth wonder of the world,” and for good reason. Here’s how it works in simple terms:

Let’s say you invest $10,000 at a 7% annual return. After one year, you have $10,700. The next year, you don’t just earn 7% on your original $10,000—you earn it on the new total of $10,700. That extra $700 also starts earning returns. Year after year, your money grows not just on what you put in, but on all the growth that’s accumulated.

Over 30 years, that initial $10,000 could grow to over $76,000 without you adding another penny. Add regular monthly contributions to that, and you’re looking at serious wealth building.

The Reality Check: Where Do You Stand?

Before we dive into strategies, let’s look at the actual data. Understanding where people typically are at different ages can help you gauge whether you’re on track, ahead, or need to catch up.

💰 Average Retirement Savings by Age

Here’s what real-world retirement account balances look like across different age groups:

| Age range / Group | Average / Median Retirement Savings* |

|---|---|

| Under 25 | ~$7,400 (Vanguard defined contribution plans) (Encyclopedia Britannica) |

| 25–34 | ~$37,600 (Encyclopedia Britannica) |

| 35–44 | ~$91,300 (Encyclopedia Britannica) |

| 45–54 | ~$168,700 (Encyclopedia Britannica) |

| 55–64 | ~$244,800 (Encyclopedia Britannica) |

| 65+ | ~$272,600 (Encyclopedia Britannica) |

Important note: These averages can be misleading because they’re skewed by wealthy outliers—people with massive retirement accounts pull the average up. The median (middle point) is often much lower, which means most people have less than these amounts saved.

If you’re under 25 with $5,000 saved, you’re actually doing better than many of your peers. If you’re 30 with $50,000, you’re crushing it. The key is understanding these benchmarks and using them as motivation, not discouragement.

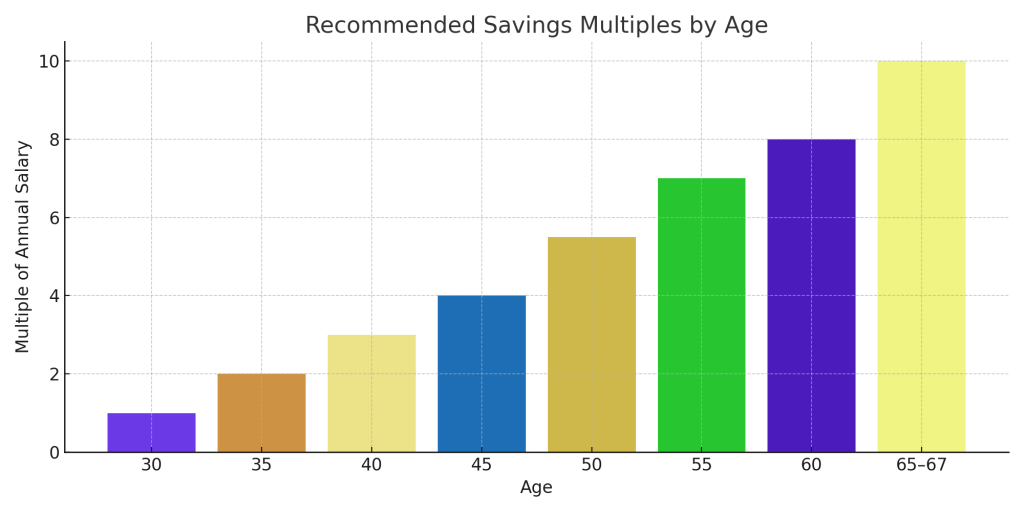

🎯 The Salary Multiplier Method: A Smarter Way to Track Progress

Rather than focusing on absolute dollar amounts, many financial planners recommend thinking about retirement savings as multiples of your annual salary. This method adjusts for income differences and gives you a more personalized target.

Here’s the benchmark framework used by major financial institutions:

| Age | Target Retirement Savings (versus annual salary) |

|---|---|

| 30 | ~1 × salary (Bankrate) |

| 35 | ~2 × salary (Huntington Bank) |

| 40 | ~3 × salary (Bankrate) |

| 45 | ~4 × salary (Huntington Bank) |

| 50 | ~5–6 × salary (Huntington Bank) |

| 55 | ~7 × salary (Huntington Bank) |

| 60 | ~8 × salary (Bankrate) |

| 65–67 | ~10 × salary (Bankrate) |

Real-world example: If you’re 35 years old earning $60,000 annually, your retirement savings goal would be around $120,000. If you’re earning $40,000, your target is $80,000. This scales to your situation.

These targets assume you want to maintain roughly the same lifestyle in retirement that you have while working. If you’re planning a more modest retirement, you might need less. Dreaming of world travel and luxury? You’ll want to aim higher.

Your Step-by-Step Action Plan: How to Actually Build This Fund

Reading statistics is one thing; taking action is another. Here’s your practical roadmap to building a retirement fund that will actually support you when you need it.

Step 1: Define Your Retirement Vision (Yes, Really)

This might sound touchy-feely, but it’s crucial. You can’t save effectively if you don’t know what you’re saving for. Spend 30 minutes thinking about:

What does your ideal retirement look like?

- Living in the same city or moving somewhere cheaper (or more expensive)?

- Traveling the world or staying close to family?

- Simple living or maintaining a higher lifestyle?

- Retiring fully or doing part-time passion projects?

What are your big-picture costs?

- Healthcare (this is often the biggest retirement expense people underestimate)

- Housing (will you own your home outright, or still have housing costs?)

- Daily living expenses

- Fun money (hobbies, entertainment, dining out)

- Supporting family members or leaving an inheritance

How long will you need this money?

- If you retire at 65 and live to 90, that’s 25 years of expenses

- If you retire early at 55, you might need 35+ years of funding

Understanding your vision helps you set realistic savings targets. Someone planning to retire in a low-cost-of-living area with a paid-off home needs far less than someone planning to maintain a high-cost urban lifestyle.

Step 2: Commit to the 10–15% Rule (And Make It Automatic)

Financial advisors consistently recommend saving 10–15% of your gross income for retirement. If that sounds impossible right now, start with what you can—even 5% is better than 0%—and work your way up as you get raises or pay off debts.

Why these percentages matter:

- At 10% savings rate starting at age 25 with average returns, you’ll likely replace about 45% of your pre-retirement income

- At 15%, you’re looking at replacing around 60–70% of your income

- The earlier you start, the more powerful these percentages become

Making it automatic is the key to success:

- Set up automatic transfers from your paycheck to your retirement account

- Schedule it for right after payday so you never “see” the money

- Start with a comfortable percentage, then increase it by 1% every year

- When you get a raise, immediately bump up your retirement contribution before lifestyle inflation kicks in

The psychological trick here is powerful: if the money never hits your checking account, you won’t miss it. People who manually transfer money to retirement accounts each month consistently save less than those who automate it.

Step 3: Take Advantage of Every Tax Benefit and Free Money

This is where you can seriously accelerate your savings with smart strategy:

Employer matching programs: If your employer offers a retirement match (like matching 50% of your contributions up to 6% of salary), contribute at least enough to get the full match. This is literally free money. If you’re not taking it, you’re giving yourself a pay cut.

Tax-advantaged accounts: Depending on your country, retirement accounts like 401(k)s, IRAs, or pension schemes offer huge tax breaks. Some let you contribute pre-tax money (reducing your taxable income now), while others like Roth accounts let you withdraw tax-free in retirement. Both are powerful tools.

Example: If you earn $50,000 and contribute $5,000 to a traditional retirement account, you might only pay taxes on $45,000 of income. That’s real money back in your pocket every year.

Step 4: Diversify Your Investments (Don’t Put All Your Eggs in One Basket)

Here’s a mistake many young savers make: they’re so focused on how much they’re saving that they forget about where they’re saving it.

Cash savings alone won’t cut it. A regular savings account might earn 1–2% interest, but inflation typically runs 2–3%. That means your money is actually losing purchasing power over time.

Investment basics for retirement:

- Stock market investments: Historically return 7–10% annually over long periods (though with ups and downs)

- Bonds: Lower returns (3–5%) but more stable

- Target-date funds: Automatically adjust from aggressive to conservative as you approach retirement

- Index funds: Low-fee options that track the overall market

The younger you are, the more aggressive you can be. If you’re 25, you can weather market crashes because you have 40 years to recover. If you’re 60, you need more stability. Most retirement accounts offer age-appropriate default options if you’re not sure where to start.

Real talk: You don’t need to become a finance expert. Many people successfully build retirement wealth by simply choosing a target-date fund (like “Target 2055 Fund” if you plan to retire around 2055) and consistently contributing. These funds handle all the complexity for you.

Step 5: Review and Adjust Regularly (But Don’t Obsess)

Set a calendar reminder to review your retirement plan every 12–18 months:

What to check:

- Are you still contributing the percentage you planned?

- Has your income changed, allowing you to save more?

- Are you on track with the age-based benchmarks?

- Do your investments still match your risk tolerance and timeline?

- Have any major life changes happened (marriage, kids, career change)?

What NOT to do:

- Check your balance daily and panic over market fluctuations

- Make emotional decisions to sell everything when the market drops

- Constantly switch investments chasing the hottest trend

The stock market goes up and down—sometimes dramatically—but over 20+ year periods, it has consistently grown. The people who succeed are the ones who keep contributing steadily through the ups and downs, not the ones who try to time the market.

Step 6: Start TODAY (Seriously, Not Monday)

This is the most important step, and the one most people skip. Analysis paralysis is real. People spend months researching the “perfect” retirement strategy and never actually open an account.

Here’s your homework for this week:

- Day 1: Open a retirement account if you don’t have one (your employer plan, or an IRA)

- Day 2: Set up an automatic contribution, even if it’s small

- Day 3: Increase that contribution by $25 or $50 if you can

- Done: You’re now ahead of most of your peers

You can optimize and adjust later. The crucial thing is to start the clock on compound growth. Every month you delay is money you’ll never get back.

Why So Many People Fall Short (And How You Can Be Different)

Let’s address the elephant in the room: if the advice is so simple, why do so many people struggle to save for retirement? Understanding the obstacles helps you overcome them.

The Real Challenges Young People Face

1. Starting salaries are often low Entry-level positions don’t pay much, and after rent, student loans, and basic expenses, 15% savings feels impossible. This is real—not an excuse.

Solution: Start with what you can, even 3–5%. As your income grows, increase your percentage. Saving $100/month in your twenties is more valuable than saving $500/month starting in your forties.

2. Competing financial priorities Student debt, building an emergency fund, saving for a house, starting a family—retirement savings compete with immediate needs.

Solution: Create a balanced plan. First, build a small emergency fund ($1,000–2,000). Then split extra money between debt payoff and retirement savings. Don’t wait until everything else is “perfect” to start retirement savings—that day never comes.

3. It feels too far away to matter When you’re 25, age 65 might as well be another lifetime. Our brains aren’t wired to prioritize rewards that far in the future.

Solution: Reframe it. You’re not saving for “old you”—you’re buying future freedom. Every $100 you save now is buying you days, weeks, or months where you won’t have to work when you’re older. You’re literally purchasing freedom.

4. Financial literacy gaps Many people simply don’t know where to start, what accounts to open, or how much they need.

Solution: You’re reading this article, so you’re already ahead. Take one action this week. Join online communities (like r/personalfinance on Reddit), read one book on investing basics, or talk to your HR department about your employer’s retirement plan.

5. Lifestyle inflation As income grows, spending grows to match it. The person earning $80,000 often has no more savings than they did earning $50,000 because their expenses expanded.

Solution: When you get a raise, immediately increase your retirement contribution by at least half the raise amount before adjusting your lifestyle. If you get a $3,000 annual raise, boost retirement savings by $1,500 and enjoy the other $1,500 in your daily life.

The Uncomfortable Truth About Retirement in the Modern World

Here’s something financial advisors don’t always emphasize enough: the retirement landscape is harder than it was for previous generations.

- Pensions are largely extinct outside government jobs

- Social Security may not be as robust for future retirees

- People are living longer, requiring funds for 25–30 years of retirement

- Healthcare costs keep rising faster than inflation

- Job security is less stable, making consistent saving harder

This isn’t meant to scare you—it’s meant to motivate you. The people who will have comfortable retirements are those who take personal responsibility now and don’t rely on external systems to save them.

The good news? You have information and tools available that previous generations didn’t. You can open a retirement account from your phone in 10 minutes. You have access to low-cost index funds that were once only available to wealthy investors. You can educate yourself for free online.

Your Retirement Mindset Shift: From Burden to Empowerment

Instead of thinking about retirement savings as a sacrifice, reframe it:

You’re not giving up money—you’re paying your future self first.

Every dollar saved is a vote for future freedom. It’s saying “I matter, and my future quality of life matters.” It’s choosing to not be dependent on others or the government in your later years.

You’re building options.

Retirement savings isn’t just about retiring at 65. It’s about having options. Options to:

- Take a lower-paying job you love without financial stress

- Support aging parents

- Weather job loss or health issues

- Retire early if you want

- Work part-time in your later years instead of full-time

You’re joining the minority who prepare.

Most people don’t save adequately for retirement. By taking action now, you’re separating yourself from the crowd and setting yourself up for a completely different future. That’s empowering.

The Bottom Line: Your Financial Freedom Starts Now

Building a retirement fund isn’t about being perfect. It’s about being consistent. It’s not about having all the answers before you start—it’s about starting and learning as you go.

Your action items for this week:

- Calculate where you currently stand using the benchmarks above

- Open a retirement account if you don’t have one

- Set up automatic contributions of at least 5–10% of your income

- Take advantage of any employer match

- Choose a simple investment option (like a target-date fund)

- Set a calendar reminder to review in one year

The data shows that most people fall short of their retirement goals. But you’re not most people. By reading this article and taking action, you’re already in the top percentage of people your age who are taking their financial future seriously.

The best time to start saving for retirement was 10 years ago. The second-best time is today. Not Monday. Not next month. Not after you pay off that credit card or get your next raise.

Today.

Your future self—sitting comfortably on a beach, traveling the world, or simply living without financial stress—will thank you for the decision you make right now. That future starts with one simple action: starting.

So what will it be? Will you be the person who wishes they’d started earlier, or the person who did?

The choice is yours. Make it count.

References

- “Average retirement savings by age | Fidelity” — Fidelity Investments Q4 2024 report. Fidelity

- “How much money you need to save for retirement” — Bankrate guide. Bankrate

- “Retirement Savings by Age” — Encyclopaedia Britannica / Vanguard data. Encyclopedia Britannica+1

- “Retirement Savings by Age — Synchrony Bank summary of data” synchrony.com+1

- “Retirement Savings by Age — Self Financial summary” Self+1